The Government of Punjab is taking significant strides to bolster the growth of small businesses with the introduction of the CM Punjab Asaan Karobar Card. This initiative aims to support small entrepreneurs by providing interest-free loans up to PKR 1 million. Utilizing a digital SME card, the program ensures structured and transparent financial assistance, making it easier for business owners to sustain and expand their operations.

Latest Posts

- Account Officer and Driver Jobs 2025 in TEVTA

- Cantt Public High School and College Sialkot Teaching Jobs 2025

- National Insurance Company NICL Doctor Jobs 2025 in Karachi

- COMSATS University Islamabad CUI Jobs 2025

- NUML University Islamabad Jobs 2025

How to Register for the CM Punjab Asaan Karobar Card

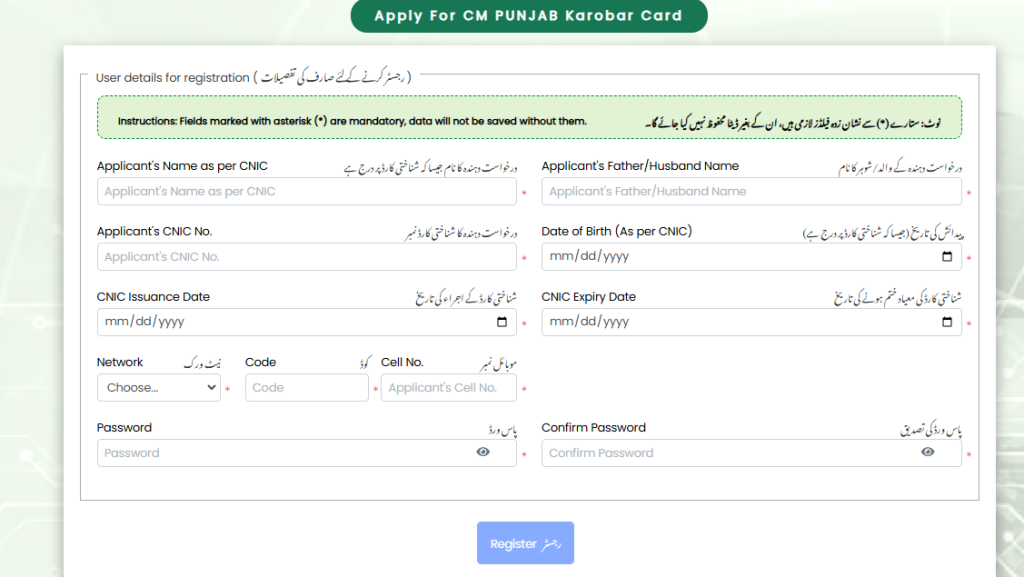

Registering for the Asaan Karobar Card is straightforward and fully digital. Here’s a simple step-by-step guide to get you started:

- Visit the Official Portal: Head over to akc.punjab.gov.pk/login to begin the registration process.

- Fill Out the Registration Form: You’ll need to provide:

- Applicant’s Name as per CNIC

- CNIC Number

- Father’s/Husband’s Name

- Date of Birth and CNIC issuance and expiry dates

- Mobile Network and Cell Number

- Password creation for account security

Submit the Form: Ensure all details are correct as per your official documents and submit the form along with a PKR 500 non-refundable processing fee.

How to Access Your Account

Once registered, logging in to access your Karobar Card is easy:

- Go to the Login Page: Visit the same portal and select the ‘Login’ section.

- Enter Your Credentials: Input your CNIC number and the password you set during registration.

Manage Your Account: After logging in, you can manage your loan, make transactions, and check your repayment schedule.

Benefits of the CM Punjab Asaan Karobar Card

The Karobar Card comes packed with benefits designed to empower small business owners:

- Zero-Interest Loans: Borrow up to PKR 1 million without worrying about interest.

- Digital Ease: Manage your finances through mobile apps and POS systems.

- Flexible Repayment: Enjoy a grace period of three months before starting your repayments, which are spread over 24 months in equal installments.

Eligibility Criteria

To apply for the card, you must:

- Be a small entrepreneur based in Punjab.

- Be between the ages of 21 and 57.

- Hold a Pakistani nationality and reside in Punjab.

- Have a business located in Punjab with a satisfactory credit history.

Key Features of the Loan

- Loan Amount: Up to PKR 1 million.

- Repayment: After a 3-month grace period, repay in 24 equal monthly installments.

- Digital Transactions: Facilitate payments to vendors, manage utility bills, and even withdraw cash for business needs.

Loan Usage and Repayment Details

The loan provides considerable flexibility:

- Initial Usage: Access the first 50% of your loan limit within the first six months.

- Repayment Terms: Start repaying after the initial grace period with a minimum monthly payment requirement.

- Further Access: Upon satisfactory usage and regular repayments, the second 50% of the loan is released.

Fees and Charges

The Asaan Karobar Card is designed to be budget-friendly for business owners, with only a few essential fees:

- Yearly Fee: PKR 25,000 (plus FED), which is subtracted from the total loan amount.

- Other Costs: Covers life insurance, card processing, and shipping fees.

- Late Fee: Applicable if repayments are delayed, based on the bank’s guidelines.

These modest charges help maintain the program’s long-term viability while delivering valuable support to small enterprises.

How to Track Your Asaan Karobar Loan Application

Once you’ve submitted your Asaan Karobar Loan application, you can monitor its progress through several convenient channels. The official tracking portal enables both local and overseas applicants to stay updated in real time.

Simply access the program’s website, sign in using your credentials, and view your current status—whether it’s “Approved” or “In Process.”

Easy Way to Track Your Asaan Karobar Application

Stay informed about your loan application through these simple methods:

✔ Online Portal: Sign in to your account for live updates. Need to submit more documents? Use the “Uploads” section for quick submission.

✔ SMS Service: Text STATUS [Your Application ID] to 8300 for an instant reply with your latest status.

✔ Customer Support: Dial 051-9053333 (Pakistan toll-free) or +92-51-9053333 (international) for direct assistance. Representatives can verify eligibility and provide updates.

✔ Branch Visit: Bring your CNIC to any National Bank of Pakistan (NBP) branch for in-person support.

Steps to Resolve a Delayed Asaan Karobar Loan Application

If your application seems stuck or shows an incorrect status, take these steps to expedite the process:

✅ Cross-Verify Your Status

Use at least two tracking methods (online portal, SMS, or helpline) to confirm your current status.

✅ Submit Pending Documents

If any documents are missing, promptly upload them in the “Uploads” section of the portal.

✅ Verify Your NADRA Records

Ensure all personal details (name, CNIC, etc.) match your NADRA records to prevent verification delays.

✅ Reach Out for Support

Contact customer service with your application reference number for personalized assistance.

✅ Monitor Progress Regularly

Frequent status checks help you spot and resolve issues early, keeping your approval on track.

Additional Features

- Security Measures: Include life assurance and a personal guarantee.

- Mandatory Registrations: Register with PRA/FBR within six months of receiving the card.

- Support for Startups: Access feasibility studies and other resources for planning and launching your venture successfully.

This initiative by the CM Punjab not only facilitates financial empowerment but also encourages entrepreneurial success across the province, making it a cornerstone for economic growth and business sustainability.

Asaan Karobar Card Helpline Number

Need help with your Asaan Karobar Card? Here’s how to get assistance:

📞 Helpline Number:

Call 1786 for immediate support with your queries.

🛠 Available Assistance:

- Registration guidance

- Eligibility requirements

- Application process help

⏰ Service Hours:

Available during regular business hours (Monday to Friday, 9 AM to 5 PM).

🌐 More Information:

Visit the website: https://akcscholarship.com for complete details.

Frequently Ask Questions FAQ’s

What is the CM Punjab Asaan Karobar Card?

The Asaan Karobar Card is a government initiative designed to support small entrepreneurs in Punjab by providing interest-free loans up to PKR 1 million to help them grow their businesses.

How can I apply for the Asaan Karobar Card?

To apply for the card, visit the official portal at akc.punjab.gov.pk/login, fill out the registration form with the necessary details, and submit it along with a PKR 500 non-refundable processing fee.

Who is eligible to apply for the Asaan Karobar Card?

Eligible applicants must be small entrepreneurs based in Punjab, aged between 21 and 57, hold Pakistani nationality, reside in Punjab, and have a satisfactory credit history.

What are the benefits of the Asaan Karobar Card?

Benefits include zero-interest loans up to PKR 1 million, digital management of finances, flexible repayment terms, and a three-month grace period before starting repayments.

How do I access my Asaan Karobar Card account after registering?

After registration, log in to your account by visiting the login section of the same portal, entering your CNIC number and password, and from there, you can manage your loan and other transactions.

What is the repayment structure for the Asaan Karobar Card?

The loan must be repaid in 24 equal monthly installments after an initial three-month grace period.

Can I use the loan immediately after receiving it?

You can access the first 50% of your loan limit within the first six months. Upon satisfactory usage and regular repayments, the second 50% is released.

What security measures are included with the Asaan Karobar Card?

The card includes life assurance and requires a personal guarantee from the borrower.

Are there any mandatory registrations required after receiving the Asaan Karobar Card?

Yes, you must register with the Punjab Revenue Authority (PRA) or the Federal Board of Revenue (FBR) within six months of receiving the card.

What additional support does the Asaan Karobar Card offer to startups?

The program offers access to feasibility studies and other resources to assist in planning and launching your venture successfully.