The Asaan Karobar Loan Scheme is an innovative initiative launched by Punjab Chief Minister Maryam Nawaz. It is specifically designed to propel the growth of Small and Medium Enterprises (SMEs) in Punjab. By providing interest-free loans, this program aims to foster entrepreneurship, create more jobs, and boost the regional economy through enhanced business activities and exports.

Who Can Apply?

The scheme is tailored for small and medium-sized businesses within Punjab, focusing on those that require financial support to start, expand, or modernize their operations.

- Small Businesses: Must have annual sales of up to PKR 150 million.

- Medium Businesses: Businesses with annual sales between PKR 150 million and PKR 800 million.

Eligibility Requirements

To qualify for the Asaan Karobar Loan, applicants must meet the following criteria:

- Age Limit: Applicants should be between 25 to 55 years old.

- Tax Status: Must be active taxpayers registered with the Federal Board of Revenue (FBR).

- Credit History: Should have a clean credit history to ensure reliability and commitment to financial obligations.

- Nationality and Documentation: Applicants must hold a valid Computerized National Identity Card (CNIC) and National Tax Number (NTN).

- Business Location: The business should have a permanent operation base, either owned or rented, within Punjab.

Loan Categories and Terms

The loan scheme is divided into two tiers to accommodate the varying needs of businesses:

- Tier 1: Offers loans from Rs1 million to Rs5 million. These loans have a repayment period of up to five years and are interest-free.

- Tier 2: Provides larger loans ranging from Rs6 million to Rs30 million, with the same interest-free benefit and a five-year repayment term.

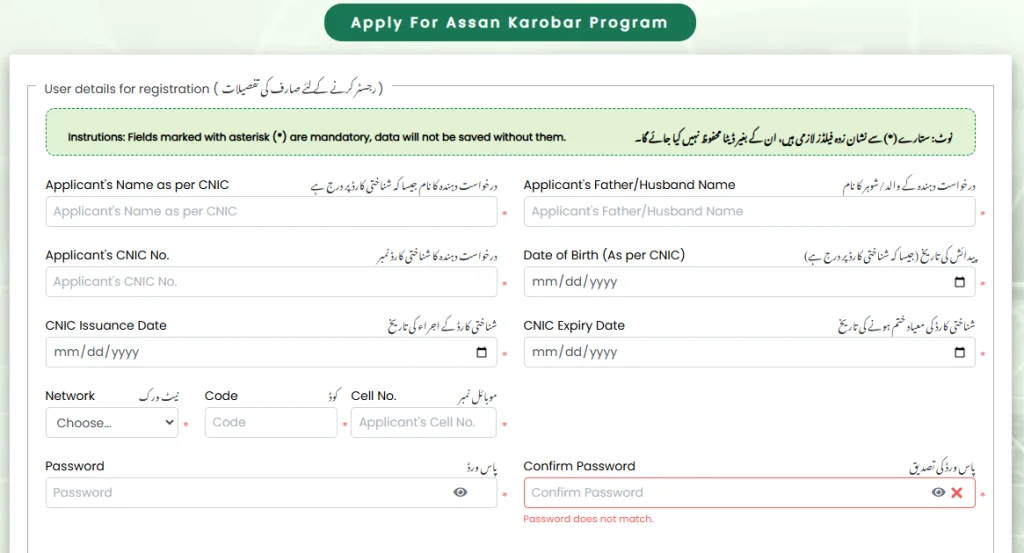

AKC Online Registration Process

Here’s how to apply for the Asaan Karobar Loan:

- Documentation: Gather all necessary documents, including your CNIC, NTN, proof of business ownership or rental agreement, and financial statements.

- Application Fee: Pay a processing fee of Rs5,000 for Tier 1 and Rs10,000 for Tier 2.

- Submission: Complete the application form available on the official Asaan Karobar website here.

- Review: After submission, your application will undergo a review process where your documents and business will be assessed.

- Approval and Disbursement: If approved, the loan amount will be disbursed as per the scheme’s terms.

Repayment and Late Charges

Repayment of the loan is required through equal monthly installments over the agreed period. If payments are delayed, a nominal charge of PKR 1 per 1,000 rupees per day will apply.

Additional Information

Startups and new businesses benefit from a grace period of up to six months, while existing businesses receive up to three months before beginning loan repayments.

Summary

The Asaan Karobar Loan Scheme represents a significant step towards economic empowerment in Punjab. By supporting SMEs, the scheme not only helps businesses flourish but also contributes to the overall economic stability of the region. Eligible entrepreneurs are encouraged to apply and take advantage of this opportunity to scale their operations and contribute to Punjab’s thriving economy.